IRS APPROVED ERO SERVING ALL 50 STATES

RAPID REFUNDS - TAX REFUND LOANS - VERY LOW FEES

OVER 15 YEARS EXPERIENCE

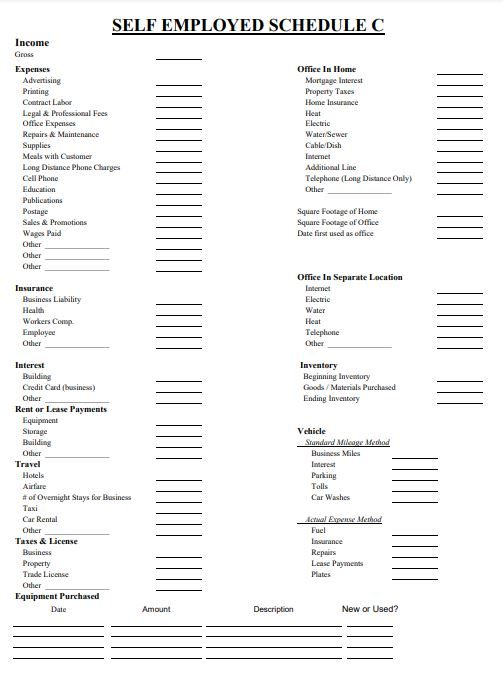

Working from home has become a way of life for many employees. Yes, pajamas are the new business casual wear. But if you’re self-employed and work from home, you can deduct a portion of your actual home office expenses on your taxes. When we say actual expenses, that means the 70-inch TV in your living room doesn’t count. But the cheesy poster of a sailboat with the caption: “Success: It’s a journey, not a destination” could count as business décor as long as it’s hanging in your office.

You can’t deduct the entire cost of your home, so you’ll need to figure out what percentage of your home is used for business. To do this, you’ll need to dig through your toolbox and find a tape measure. Measure the length and width of your office and multiply those two numbers to get the area.

Let’s say you live in a 1,200-square-foot home and your office is 12-by-12 feet. That means the area of your office is 144 square feet. To find the percentage of your home used for business, divide the area of your office (144) by the total area of your home (1,200) and you come up with 12%. That means you can deduct 12% of your home’s expenses.

So what expenses can you deduct? Well, they include your utility bills (electricity, water and gas), rent, property taxes, mortgage interest, homeowners insurance, repairs and maintenance.1 But if you don’t want to track down all those bills to compute your deduction (organizing documents is an underappreciated art form), the IRS offers a simplified method that calculates your deduction based on $5 per square foot of office space, up to a maximum of 300 square feet.2 But fair warning: If you use the simplified method, you’ll probably end up with a smaller deduction.

The first and easiest way is to keep track of the miles you drive for work and multiply them by the standard mileage rate for 2021, which is 56 cents per mile.3 So if you drove 500 miles for business last year, you can take a $280 deduction.

The big thing to remember is to keep detailed records of your mileage, noting the date and purpose of your travel. (That 800 miles you drove to Orlando to see Mickey doesn’t count.) You can track miles the old-fashioned way with a notebook you keep in your car, or you can download a smartphone app that will do most of the work for you.

Deducting actual car expenses is the second (and much more complicated) way of getting a deduction. To do this, you have to figure out the percentage you use your car for business use. For instance, if you’re a carpenter and drive your car 15,000 miles a year: 5,000 miles for business and 10,000 for personal use, you can deduct 33% of your car’s expenses. These include car payments, gas, oil changes, repairs, insurance and parking fees. You’ll need to document all these expenses, so you might have a mountain of receipts at the end of the year.

If you purchase a car and use it for business more than 50% of the time, you can take a one-time deduction called a section 179 expense for the total cost of the car multiplied by the percentage it’s used for business.4 So the deduction for a $24,000 car used for business 50% of the time would be $12,000. But if you don’t want or need to take the full deduction all at once, you could depreciate the asset and take smaller deductions over the course of several years.

Smartphones ain’t cheap! You can deduct the cost of your phone and internet service. To calculate your deduction, you have to figure out the percentage you used your phone and internet for business and personal use. That’s probably an impossible task since business and personal use often get blended, but just do your best to come up with a close estimate and make sure to keep billing statements and document your math in an orderly way (not on a cocktail napkin). If you pay for a dedicated phone line or internet connection for your home office, then you can deduct the full amount.

If something costs more than $2,500, you can use a section 179 expense deduction (mentioned above) to deduct the whole amount or depreciate the asset and take smaller deductions over the course of several years. Say you purchased a $5,000 computer. Depreciation involves taking the cost of the machine ($5,000) and dividing it by its life expectancy (say, five years) to come up with a $1,000 deduction that you’d be able to take every year for five years. We’re keeping the math simple!

You don’t have to eat every meal on the cheap (we won’t judge you for scarfing burgers). But if you order a $200 bottle of Dom Perignon with your burger, that’ll get flagged as lavish. If you don’t keep track of your meal receipts, you can compute your deduction based on the standard meal allowance, which ranges from about $60 to $80 per day depending on the city.

TRAVEL AND MEALS EXPENSE ALERT!

EXCESSIVE TRAVEL AND MEALS DEDUCTIONS WITH LIMITED EARNINGS WILL GENERATE A GREATER CHANCE FOR AUDIT.

You can deduct tuition, fees and the cost of books for education or training that improves or maintains your skills for your existing business. The key is that the expenses must improve your existing skills. Basket-weaving classes aren’t going to cut it (unless you’re a self-employed basket weaver).

So, if you’re a freelance writer and attend a writer’s workshop to hone your craft, that’s deductible. But if you decide to take college classes on computer programming because you want to change careers, that’s not deductible from self-employment taxes (though you might be able to claim the Lifetime Learning Credit on your taxes). But if you need more education to find a job you love, don’t let a tax deduction keep you from going back to school.

Membership fees are deductible for organizations, including boards of trade, business leagues, chambers of commerce, civic organizations, professional associations, real estate boards and trade associations. Fees for clubs that are designed for business or pleasure, like country clubs, sporting clubs or airline clubs, are not tax deductible.

Publications directly related to your business, such as trade journals, magazines or books, are deductible. But that copy of People you grabbed in the checkout line? Nope.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.