IRS APPROVED ERO SERVING ALL 50 STATES

RAPID REFUNDS - TAX REFUND LOANS - VERY LOW FEES

OVER 15 YEARS EXPERIENCE

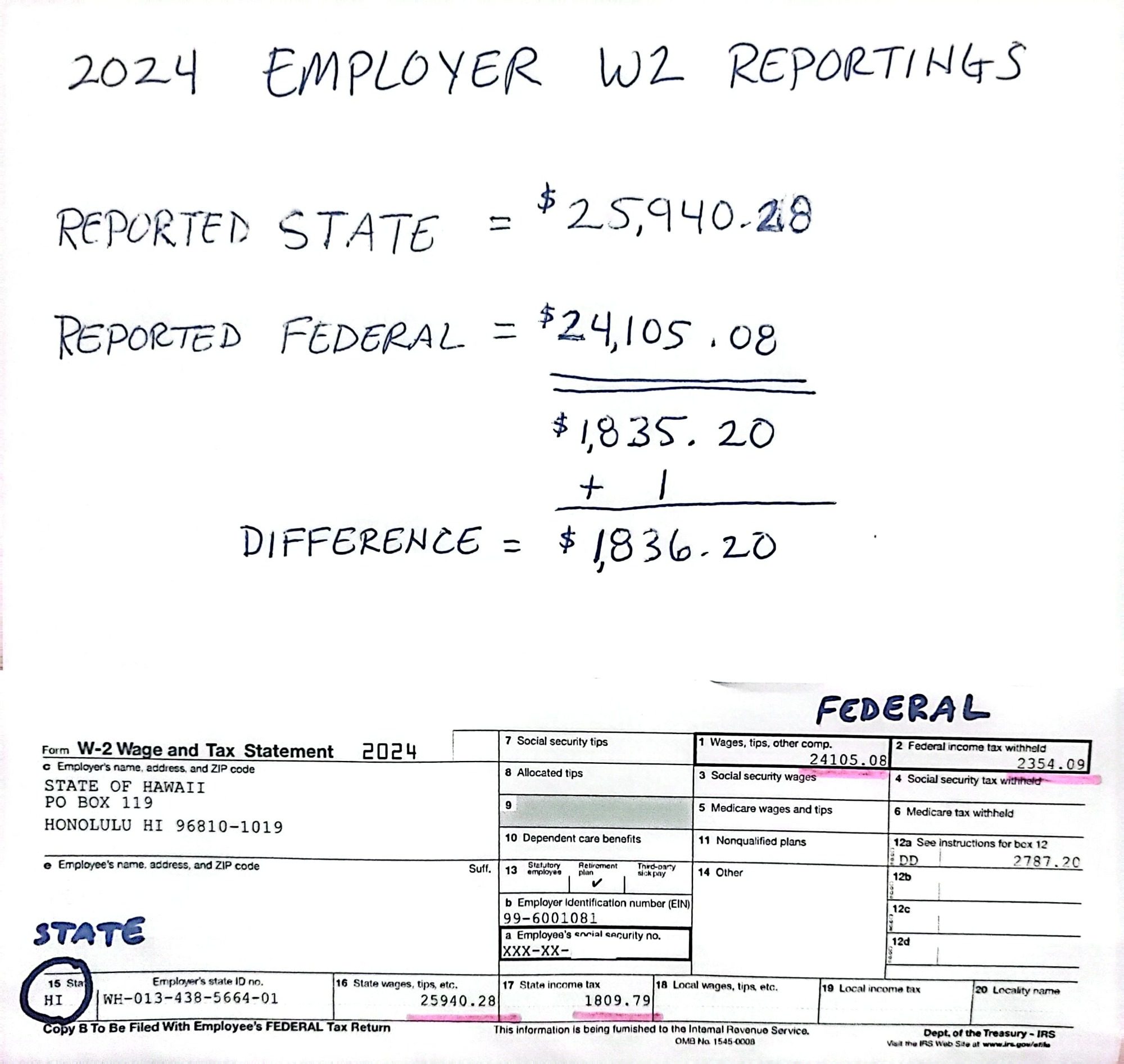

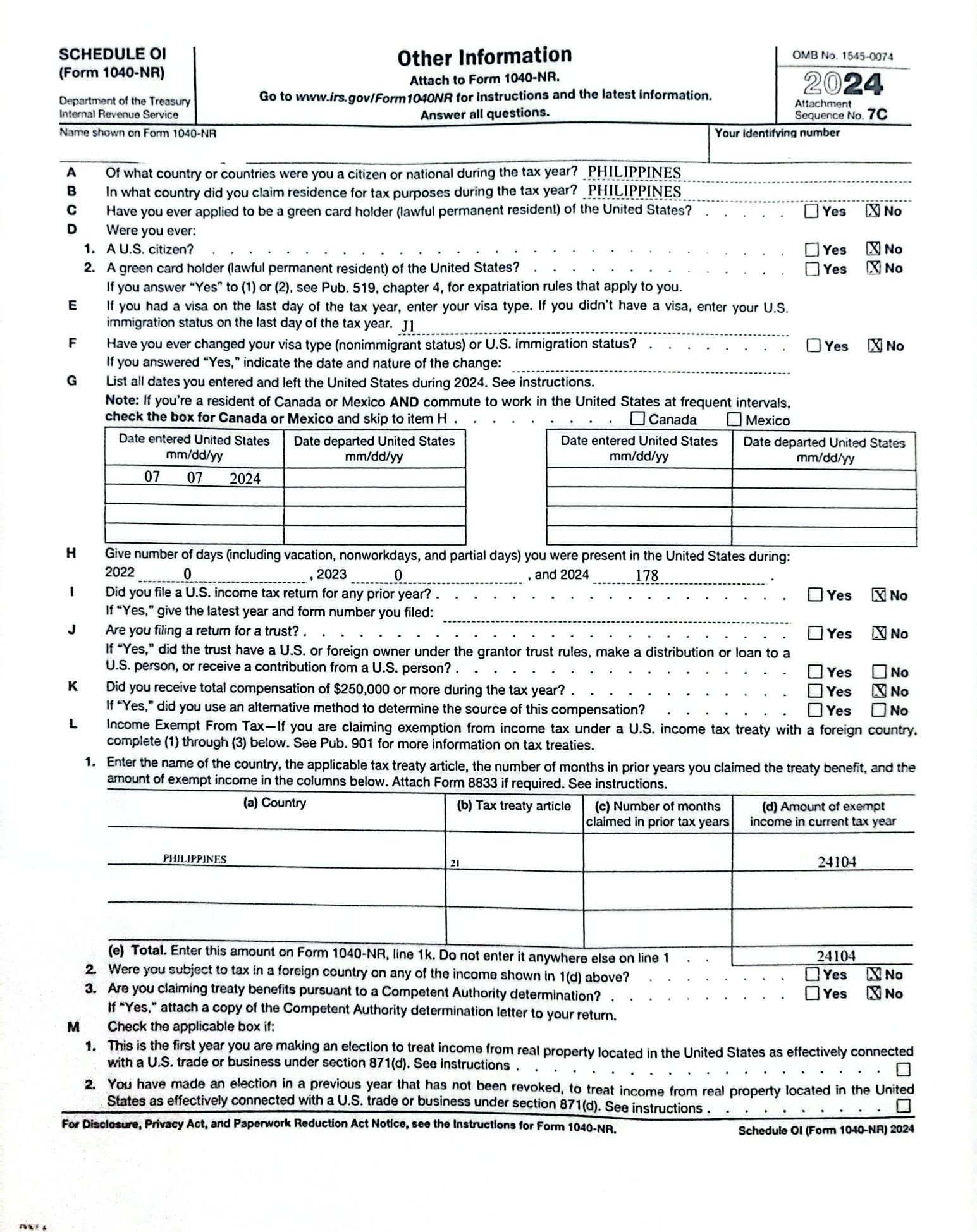

The States are not bound to honor Federal tax treaties, but most do.

State income tax forms usually start with federal taxable income, or federal adjusted gross income, and require a few adjustments. Income excluded by US treaties are usually excluded from States income tax.

However, several States "DO NOT HONOR" Federal Tax treaties: if you live or work in one of these states, you will most likely owe State income tax even though your income is exempt from Federal income tax by a treaty.

Those are:

The states that do not impose an income tax on individuals are:

States that do not impose an income tax on wages are:

Many states use federal taxable income as the starting point for determining state income tax liability.

As a result, if there is no federal taxable income there may also not be any state taxable income.

However, a number of states define federal taxable income by reference only to the U.S. federal income tax rules without regard to treaty rules and require an “add-back” to federal taxable income for any income that is excluded under a treaty.

One frequent question that arises is the extent to which U.S. income tax treaties can apply to reduce state income tax.

The prevailing opinion is that income tax treaties are limited to “federal income taxes imposed by the Internal Revenue Code” as stated in the treaty, but that opinion is incorrect.

This incorrectness is especially true regarding States that Defer to Section 61.

Regarding States that Defer to Section 61; which most states (but not all) do in fact defer to Internal Revenue Code section (herein “Section”) 61 for the definition of “gross income.”[1] Section 61 states “Except as otherwise provided in this subtitle, gross income means all income from whatever source derived.” The key phrase here is “[e]except as otherwise provided in this subtitle.”

This phrase means that other provisions in Title 26, Subtitle A, of the U.S. Code modify Section 61. One such provision under Subtitle A is Section 894

Section 894(a)(1) mandates that all “provisions of [the Internal Revenue Code] shall be applied to any taxpayer with due regard to any treaty obligation of the United States which applies to such taxpayer.”

In other words, Section 61 is statutorily modified and to be applied consistent with any treaty obligation that applies to a taxpayer.[2] By operation of Section 894(a)(1), Section 61 is modified to the extent there is an applicable income tax treaty.

Therefore, if the state defers to Section 61 for the definition of gross income, which is modified by any applicable income tax treaty in accordance with Section 894(a)(1), then it logically follows that any income excluded from an individual U.S. federal income tax return pursuant to an applicable income tax treaty is excludible on said individual’s state individual income tax return.

States that Do Not Defer to Section 61, Where federal and state statutes and regulations are substantially identical, the interpretation and effect given to the statute by federal courts is highly persuasive. [3] That being said, even in states where state tax law does not expressly defer to Section 61 yet defines gross income in a substantially identical manner, there is legal authority for the proposition that income tax treaties apply.

There are more specifics to the IRS tax Codes, Case law and other relevant details that we will reference which are not listed here on this page. Those details will be added to and addressed in any letter that we draft on your behalf.

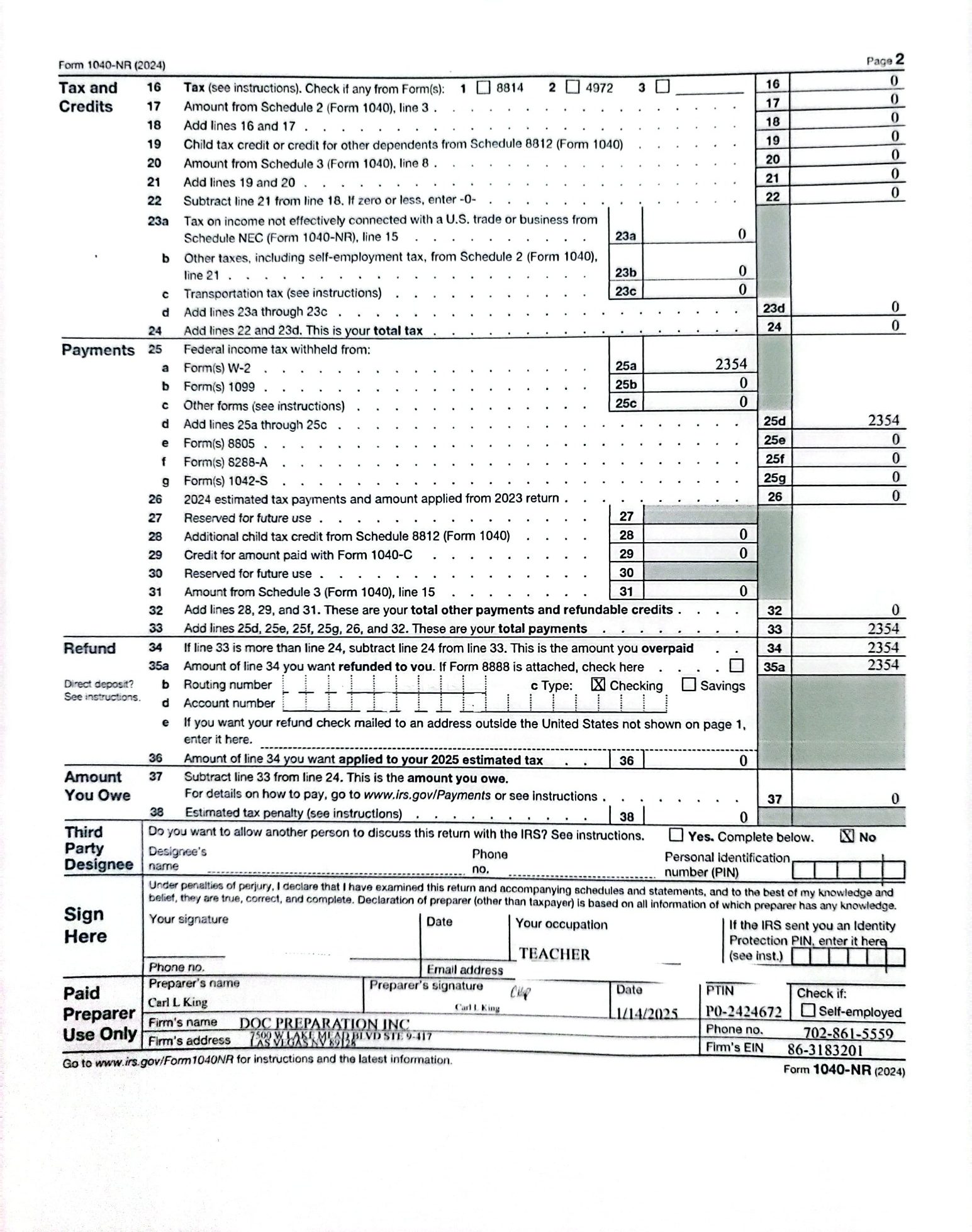

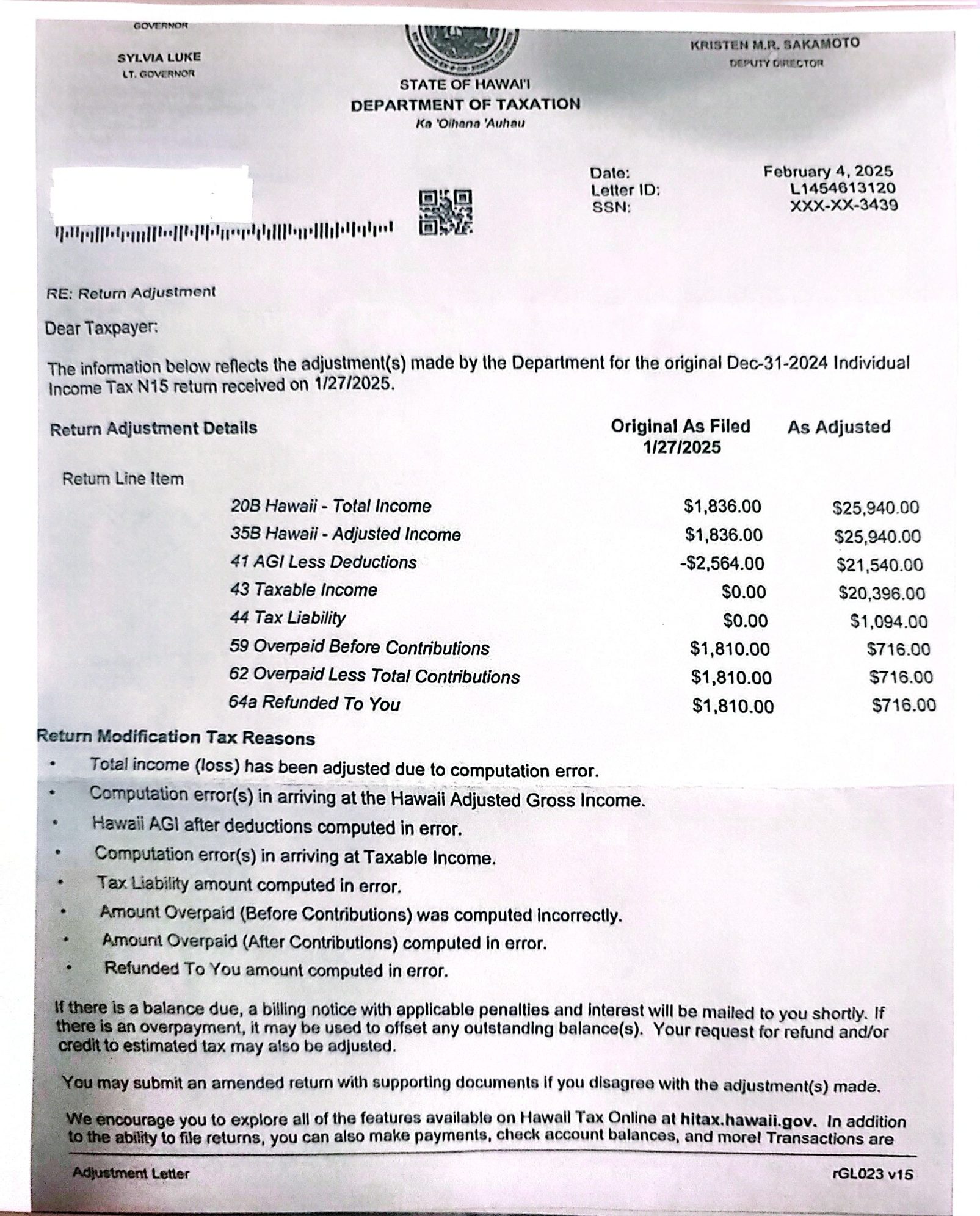

IF YOU HAVE RECEIVED A NOTICE FROM THE IRS OR FROM YOUR STATE TAXATION DEPARTMENT; YOU CAN UPLOAD THE NOTICE AT THE LINK BELOW.

IF YOU WOULD LIKE TO HAVE A PERSONALIZED LETTER FROM US TO SEND IN TO THE IRS OR TO YOUR STATE TAX DEPARTMENT; WE WILL DRAFT ONE FOR A PREPAID FEE OF $75 PER LETTER.

BE ADVISED, WE DO NOT MAIL ANY NOTICES TO THE IRS NOR TO ANY STATE TAXATION DEPARTMENT ON YOUR BEHALF. THAT IS YOUR RESPONSIBILITY TO REPLY AND SEND THEM WHAT THEY ARE ASKING FOR ON THE NOTICE.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.