IRS APPROVED ERO SERVING ALL 50 STATES

RAPID REFUNDS - TAX REFUND LOANS - VERY LOW FEES

OVER 15 YEARS EXPERIENCE

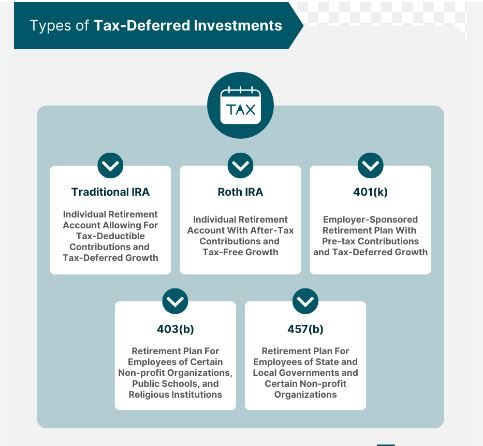

Benefits and Why invest in an IRA?

IRAs allow you to save for retirement and potentially take advantage of tax benefits. Depending on which IRA you choose, your tax benefits could include:

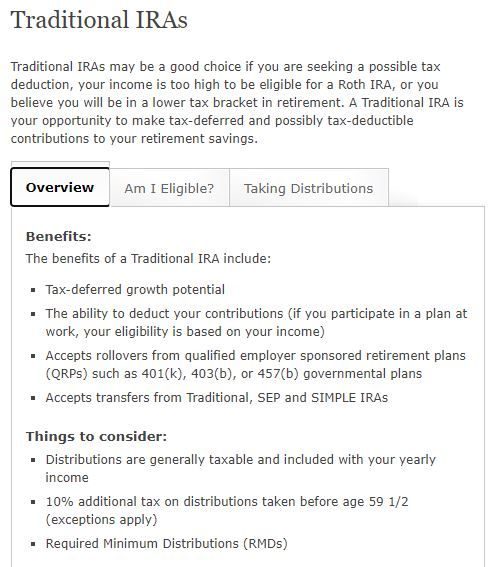

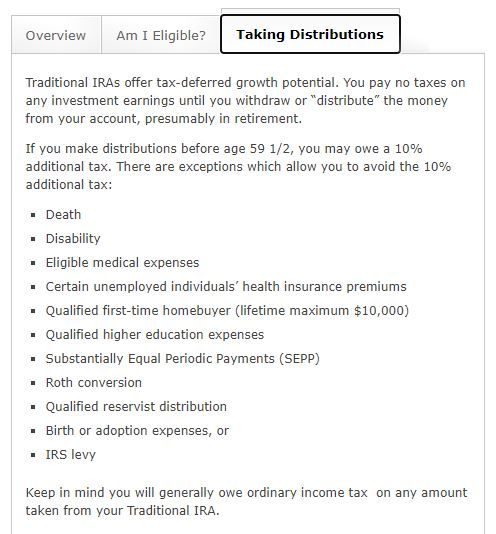

A Traditional IRA offers tax-deferred growth potential. You pay no taxes on any investment earnings until you withdraw, or “distribute,” the money from your account, presumably in retirement.2

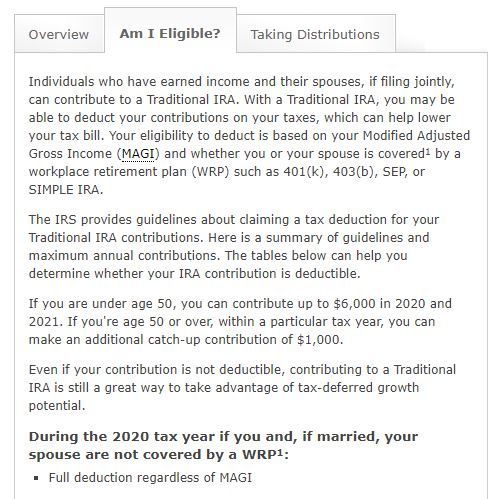

You can contribute to a Traditional IRA regardless of your age, as long as you, or your spouse, if filing jointly, have earned income, but your contribution may not be fully deductible. Your ability to deduct contributions generally depends on your participation in a workplace retirement plan (WRP)3 and your income.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.