IRS APPROVED ERO SERVING ALL 50 STATES

RAPID REFUNDS - TAX REFUND LOANS - VERY LOW FEES

OVER 15 YEARS EXPERIENCE

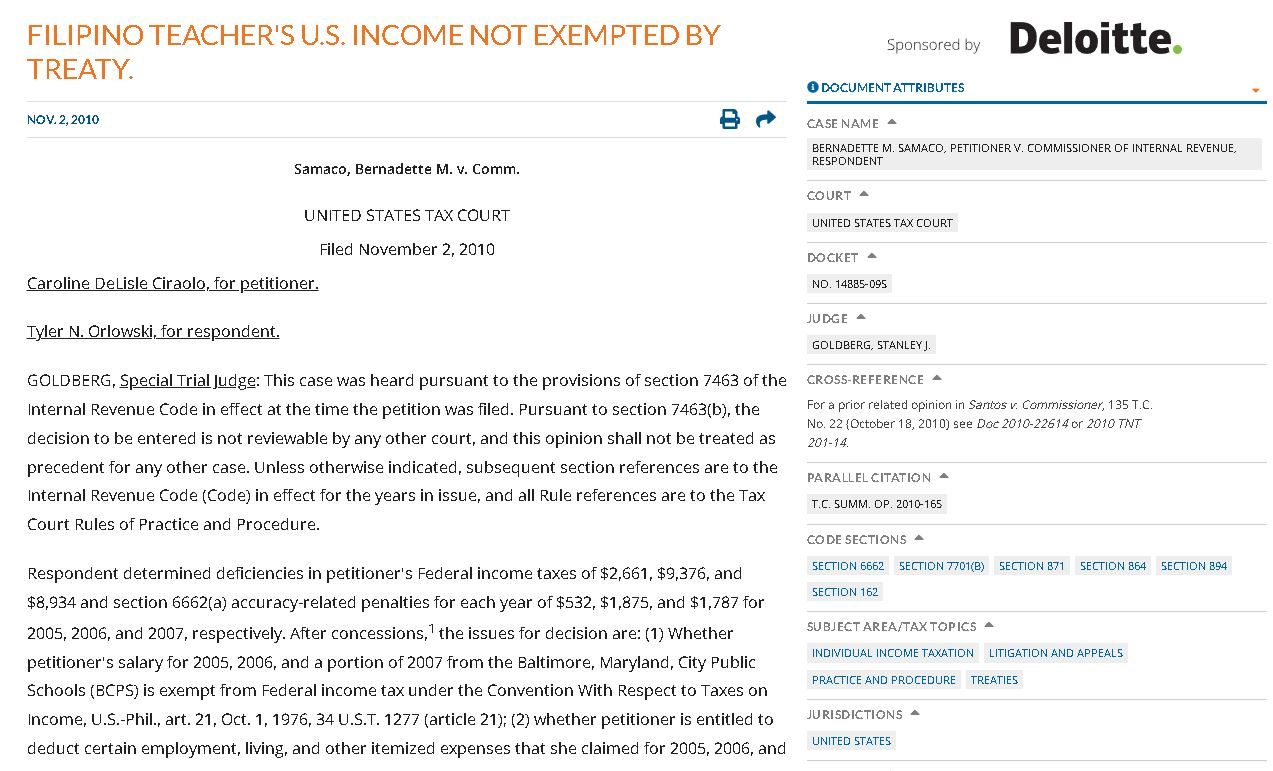

Samaco, Bernadette M. v. Comm.

UNITED STATES TAX COURT

Filed November 2, 2010

Caroline DeLisle Ciraolo, for petitioner.

Tyler N. Orlowski, for respondent.

GOLDBERG, Special Trial Judge: This case was heard pursuant to the provisions of section 7463 of the Internal Revenue Code in effect at the time the petition was filed. Pursuant to section 7463(b), the decision to be entered is not reviewable by any other court, and this opinion shall not be treated as precedent for any other case. Unless otherwise indicated, subsequent section references are to the Internal Revenue Code (Code) in effect for the years in issue, and all Rule references are to the Tax Court Rules of Practice and Procedure.

Respondent determined deficiencies in petitioner's Federal income taxes of $2,661, $9,376, and $8,934 and section 6662(a) accuracy-related penalties for each year of $532, $1,875, and $1,787 for 2005, 2006, and 2007, respectively. After concessions,1 the issues for decision are: (1) Whether petitioner's salary for 2005, 2006, and a portion of 2007 from the Baltimore, Maryland, City Public Schools (BCPS) is exempt from Federal income tax under the Convention With Respect to Taxes on Income, U.S.-Phil., art. 21, Oct. 1, 1976, 34 U.S.T. 1277 (article 21); (2) whether petitioner is entitled to deduct certain employment, living, and other itemized expenses that she claimed for 2005, 2006, and 2007; and (3) whether petitioner is liable for the accuracy-related penalty under section 6662(a) for each of the 3 years at issue.

BACKGROUND

Some of the facts have been stipulated and are so found. The stipulation of facts and the attached exhibits are incorporated herein by this reference. Petitioner resided in Maryland when she filed her petition.

Petitioner is a citizen of the Republic of the Philippines. She received a bachelor's degree in early childhood education from Miriam College. She then attended Atenao-de-Manila, where she received a master's degree in educational administration. Both of these institutions are in the Philippines. Petitioner began teaching in 1993. Petitioner taught third grade at Clarett School in Kanos City, Philippines, from 1996 until she left the Philippines in 2005.

Petitioner entered the United States on June 22, 2005, arriving in Baltimore to teach for BCPS as part of an international teaching exchange program sponsored by the U.S. Department of State (the State Department). Amity Institute (Amity) is a nonprofit organization the State Department approved to operate an exchange teacher program. The exchange teacher program allows qualified foreign teachers to enter the United States to teach for up to 3 years.

In conclusion

After an objective examination of all of the relevant facts and circumstances, we find that petitioner and BCPS expected petitioner to stay in the United States for at least 3 years, which is greater than the "not expected to exceed 2 years" requirement of article 21. Therefore, petitioner's income for June 2005 to June 2007, the first 2 years she was in the United States, is not exempt from Federal income tax under article 21.

IV. Conclusion

The Court has considered all arguments made in reaching our decision, and, to the extent not mentioned, we conclude that they are moot, irrelevant, or without merit.

To reflect the foregoing,

Decision will be entered under Rule 155.

FOOTNOTES

1 Respondent also determined that petitioner did not include income from Form W-2, Wage and Tax Statement, from Edison School, Inc., for 2005 or State income tax refunds and interest income in her gross income for 2006 and 2007. Petitioner did not address these issues at trial; therefore, the issues are deemed conceded. See Rule 149(b).

2 As a teacher, petitioner is considered an exempt individual and therefore not treated as present for purposes of the substantial presence test. See sec. 7701(b)(1)(A)(ii), (3)(D)(i), (5)(A)(ii).

In most cases, the last lines of the court’s opinion will state whether the decision is to be entered for the petitioner (taxpayer), for the respondent (Service), or under T.C. Rule 155. A decision will be entered for the petitioner when the taxpayer has prevailed on all of the issues before the court and has not made any concessions.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.