IRS APPROVED ERO SERVING ALL 50 STATES

RAPID REFUNDS - TAX REFUND LOANS - VERY LOW FEES

OVER 15 YEARS EXPERIENCE

KEY POINTS RELATED TO THE FEDERAL TAX BRACKETS

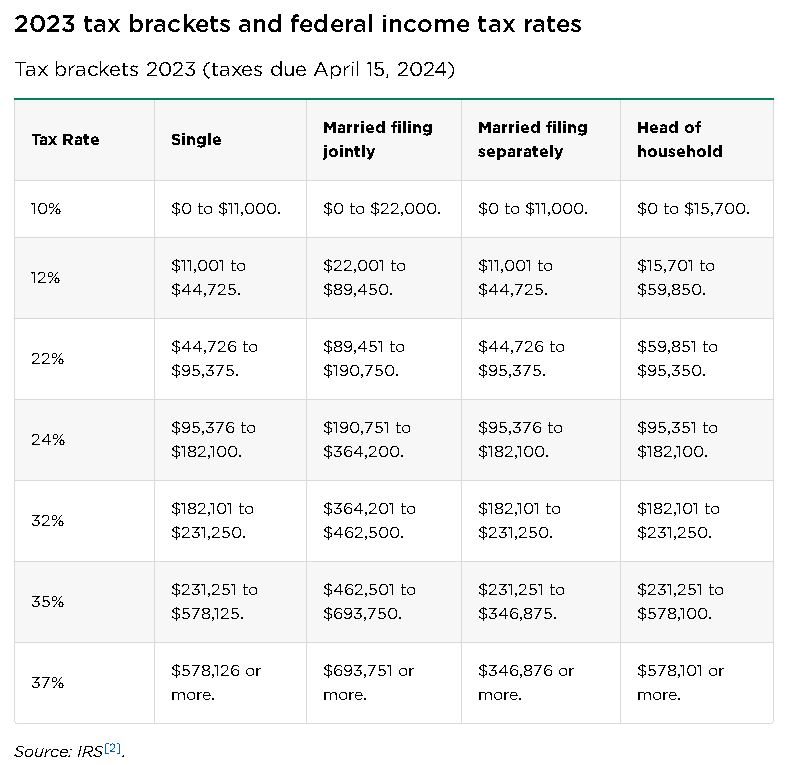

Example of FEDERAL Tax Brackets:

Below is an example of marginal tax rates for a single filer based on 2022 tax rates.

Consider the following tax responsibility for a single filer with a taxable income of $50,000 in 2022:

Add the taxes owed in each of the brackets:

The individual’s effective tax rate is approximately 13% of income:

Pros and Cons of Tax Brackets:

Tax brackets—and the progressive tax system that they create—contrast with a flat tax structure, in which all individuals are taxed at the same rate, regardless of their income levels.

Pros

Cons

WHO WANTS TO PUT MORE MONEY IN YOUR POCKET?

WHY GIVE IT AWAY TO THE IRS?

Above is a detailed video (less than 9 minutes) explaining the tax brackets in greater detail. It gives great explanations and ideas on how to reduce your taxable income which is your AGI (Adjusted Gross Income). As we discussed, by simply lowering your taxable income, you may qualify for even more tax credits and further reduce your tax liabilities which ultimately puts more money in your pocket annually and may contribute to more money available to you at the time of your desired retirement age.

0:00 Intro

0:24 2024 Tax Brackets

1:55 2024 Standard Deductions

2:34 Simple Tax Calculator

4:18 Roth Vs. Traditional Retirement plan tax example

4:45 2024 Retirement Plan Limits

5:44 Tax Credit and Deductions

7:09 Retire Early

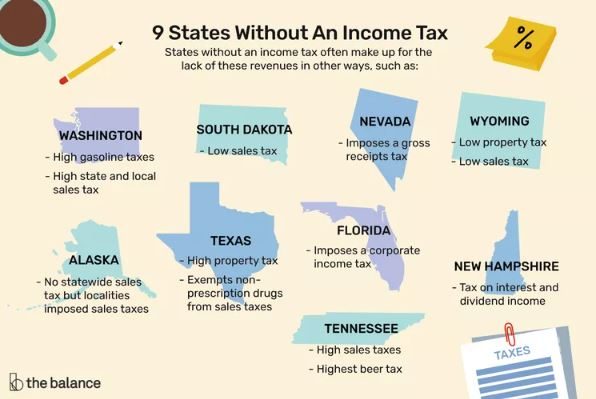

In 2022, nine states had a flat rate structure, with a single rate applying to a resident’s income:

In other states, the number of tax brackets varies from three to as many as nine (in California, Iowa, and Missouri) and even 12 (in Hawaii). The marginal tax rates in these brackets also vary considerably. California has the highest, maxing out at 12.3%.

State income tax regulations may or may not mirror federal rules. For example, some states allow residents to use the federal personal exemption and standard deduction amounts for figuring state income tax. In contrast, others have their own exemption and standard deduction amounts.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.