IRS APPROVED ERO SERVING ALL 50 STATES

RAPID REFUNDS - TAX REFUND LOANS - VERY LOW FEES

OVER 15 YEARS EXPERIENCE

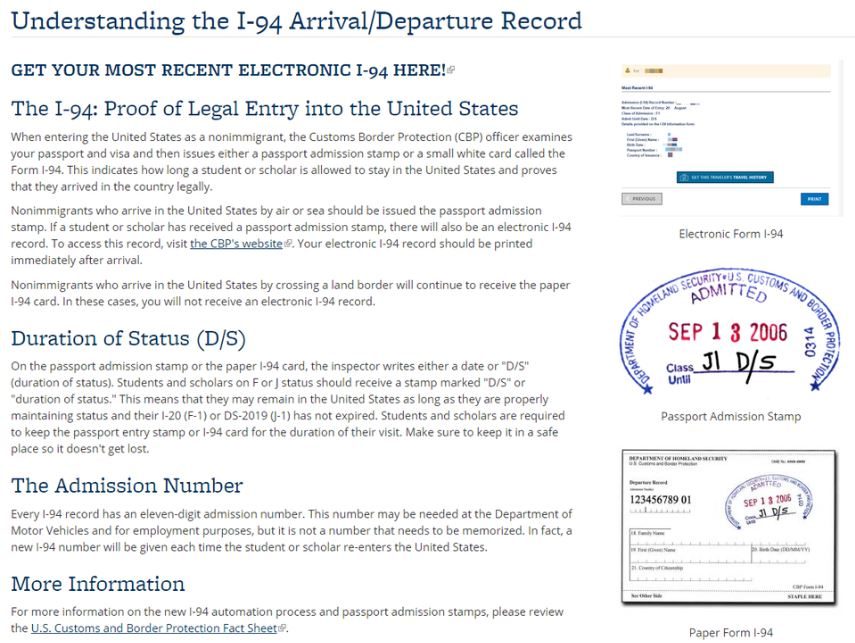

Note, however, aliens may reside in the United States to work as a teacher, intern or trainee under several different immigration status classifications, including and H-1B status. It is important to distinguish between the J-1 status and the H-1B status because the tax consequences are significantly different. For more information about the J-1 immigration status, visit the Department of State website.

In general, an alien in J-1 status (hereafter referred to as a “J-1 alien”) will be treated as a U.S. resident for federal income tax purposes if he or she meets the Substantial Presence Test. The test is applied on a calendar year-by-calendar year basis (January 1 – December 31). Under certain circumstances, a J-1 alien who fails to meet the Substantial Presence Test may be able to choose to be treated as a U.S. resident for the tax year. For more information on this choice, refer to the discussions on “First-Year Choice” and “Nonresident Spouse Treated as a Resident” in Publication 519, U.S. Tax Guide for Aliens.

The term “student” refers to any alien individual (and that individual’s immediate family) who is admitted temporarily to the United States on an “F” or “M” visa or as a student on a "J” or "Q" visa, and who substantially complies with the requirements of that visa.

The term “teacher or trainee” refers to any individual (and that individual’s immediate family), other than a student, who is admitted temporarily to the United States on a “J” or “Q” visa, and who substantially complies with the requirements of that visa. In general, the term includes any alien individual present in the United States on a "J" or "Q" visa for a purpose other than studying. For example, alien physicians, au pairs, short-term scholars, and summer camp workers in "J" visa status; and cultural exchange visitors in "Q" status are all within the definition of “teacher or trainee”.

INCOME TAX TREATY EXEMPTION

The United States has bilateral income tax treaties with over 65 countries and many treaties provide specific benefits for J-1 aliens under the Students/Trainees article and/or the Teachers/Researchers article of the applicable treaty. Each treaty provision is unique and must be examined to determine the applicable treaty benefits for J-1 teachers, researchers, trainees, and students. These types of treaty benefits, which may exempt certain income from U.S. tax, generally apply only for a specified period of time, usually 4 to 5 years from the date of entry for students and trainees, and 2 to 3 years from the date of entry for Teachers and Researchers.

A J-1 teacher from the Philippines has a tax exemption under treaty which is calculated on a monthly basis for 24 consecutive months from date of entry (not to exceed 2 years in totality). This may be different for those with other Countries of origin. There are also other treaty provisions (e.g., Independent and Dependent Personal Services, Teacher/Researcher, and Student/Trainee articles) that may be applicable to J-1 aliens.

https://www.irs.gov/individuals/taxation-of-alien-individuals-by-immigration-status-j-1#:~:text=Generally%2C%20a%20J%2D1%20alien%20cannot%20exclude%20U.S.%20day%20of,up%20to%20four%20calendar%20years.

If the J-1 alien is treated for U.S. income tax purposes as a resident of a country with which the United States has an income tax treaty, he or she may benefit from a reduced rate of U.S. federal income tax on certain types of U.S. source income. For treaty benefits involving personal services income, the J-1 alien should submit a signed Form 8233, Exemption From Withholding on Compensation for Independent (and Certain Dependent) Personal Services of a Nonresident Alien Individual, to the payor of the income. For treaty exemptions involving types of income other than personal services income, the J-1 alien should submit a Form W-8BEN, Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding, to the payor of the income. Such income is reported to the IRS on Forms 1042 and 1042-S by the payor of the income after the end of the year.

Note: J-1 aliens who do not timely submit the Form 8233 and/or Form W-8BEN to claim treaty benefits for purposes of an exemption or reduced rate of withholding from the payor of income may still claim the treaty benefits when filing their individual U.S. income tax return.

For more information, please refer to:

A. NON-RESIDENT ALIENS

J-1 aliens who are nonresident aliens on the last day of the taxable year generally must report their U.S.-source fixed, determinable, annual, or periodical (FDAP) income (e.g., compensation earned from working in the United States) and income effectively connected with a U.S. trade or business (ECI) on Form 1040-NR, U.S. Nonresident Alien Income Tax Return. For details on these rules, refer to Taxation of Nonresident Aliens.

If claiming treaty benefits, J-1 aliens must report both the income and the treaty benefit on Form 1040-NR, with Schedule OI and Form 8833 (if required). Please refer to Claiming Tax Treaty Benefits.

If a J-1 alien qualifies to exclude days of presence as either a “student” or a “teacher or trainee,” he or she must attach a fully-completed Form 8843, Statement for Exempt Individuals and Individuals with a Medical Condition to their income tax return. If no return is required to be filed, Form 8843 must be mailed separately to the IRS at the address indicated in the General Instructions by the due date for filing Form 1040-NR.

B. RESIDENT ALIENS

Once the 24 months of income tax treaty exemptions has expired, a J-1 teacher will be considered a "resident alien" for tax purposes only. J-1 aliens who are U.S. resident aliens for the entire taxable year must report their entire worldwide income on Form 1040, U.S. Individual Income Tax Return, in the same manner as if they were U.S. citizens. If they also paid foreign income tax on foreign-source income, they may be eligible for foreign tax credits.

For more information, please refer to:

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.