IRS APPROVED ERO SERVING ALL 50 STATES

RAPID REFUNDS - TAX REFUND LOANS - VERY LOW FEES

OVER 15 YEARS EXPERIENCE

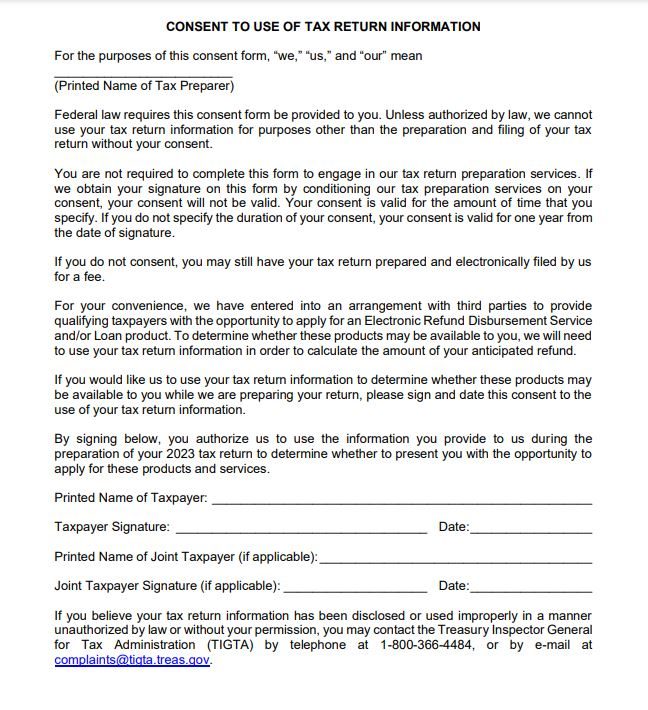

Federal law requires this consent form be provided to you. Unless authorized by law, we cannot use your tax return information for purposes other than the preparation and filing of your tax return without your consent. You are not required to complete this form to engage in our tax return preparation services.

If we obtain your signature on this form by conditioning our tax preparation services on your consent, your consent will not be valid. Your consent is valid for the amount of time that you specify. If you do not specify the duration of your consent, your consent is valid for one year from the date of signature.

If you do not consent, you may still have your tax return prepared and electronically filed by us for a fee. For your convenience, we have entered into an arrangement with third parties to provide qualifying taxpayers with the opportunity to apply for an Electronic Refund Disbursement Service and/or Loan product.

To determine whether these products may be available to you, we will need to use your tax return information in order to calculate the amount of your anticipated refund.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.